The Indices

The Real Carbon Price Indices, developed by Monash, C2Zero and SparkChange represent a family of indices and analytics related to the physical price of carbon.

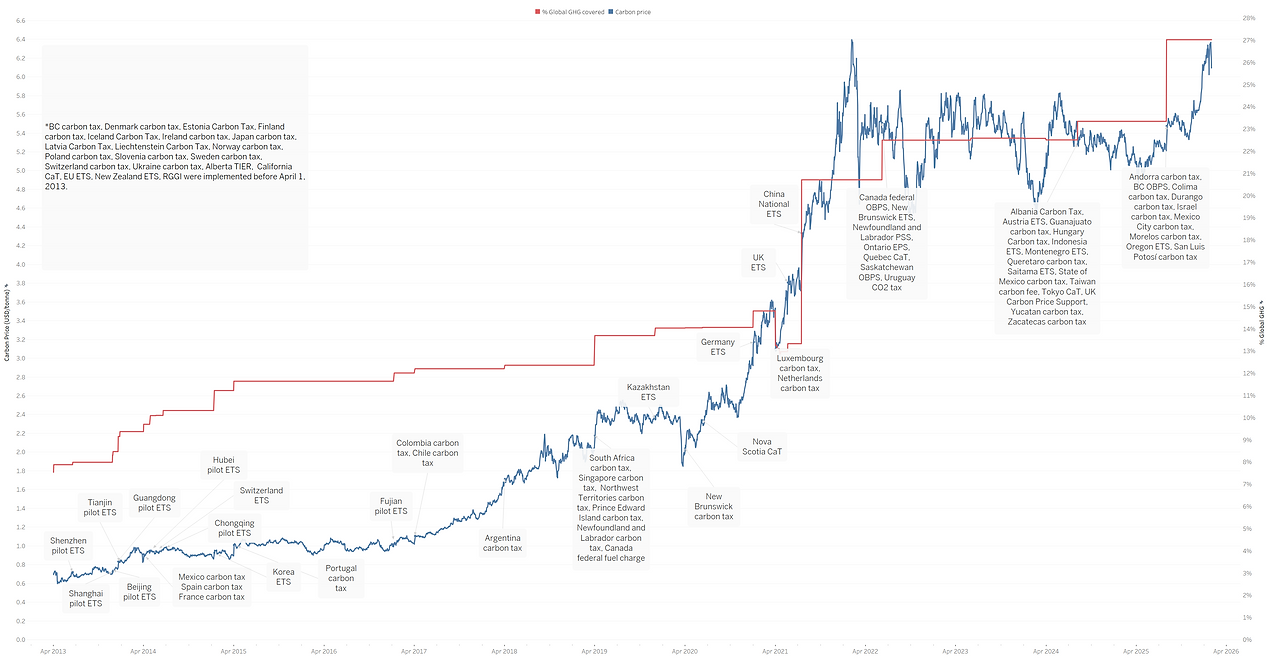

Unlike other instruments, the underlyings for the Real Carbon Indices are related to the real price for emissions across the globe. These come in the form of carbon taxes and emissions allowances which underly the various mandatory emissions trading systems and cap and trade schemes across the globe.

Members of the Real Carbon Price Index Family fall into five main groups:

-

The Real Carbon Price Indices represent the carbon price across all emissions from all jurisdictions. This includes emissions which are covered by a carbon price and those which are not – the latter being included as a zero price. These indices enable a carbon price and price history to be determined which reflects the global value of carbon.

-

The Aggregate Real Carbon Price Indices are a subset of the Real Carbon Price Indices (above), which exclude zero prices (ie emissions from regions which do not set a carbon price). These indices can be grouped in various ways including by region, by instrument type or by pollutant or polluting activity. An example is the Aggregate Real Carbon Tax Rate which covers all jurisdictions for which a carbon tax is levied.

Both the Real Carbon Price Indices and the Aggregate Real Carbon Price Indices represent the (current or historical) price of carbon. This means that as the structure of carbon markets change – for example when a new jurisdiction introduces an emissions trading scheme or a carbon tax – there will be a discontinuous change in the carbon price in the relevant index.

-

The Rebalancing Real Carbon Price Indices cover the same universe as the Aggregate Real Carbon Price Indices. The main difference is that periodically, these indices are rebalanced to reflect constituent changes (additions/deletions) and changes in the scope or coverage of their constituents. These indices do not reflect a pure “price” of carbon over time. Rather, they reflect the change in the value of a (real or hypothetical) investment in the basket of instruments which underlie the relevant index. The rebalancing methodology for these indices is analogous to the rebalancing which takes place in traditional equity and other market indices. It may not be possible in all instances to physically replicate these indices.

-

The Investible Real Carbon Price Indices are a subset of the rebalancing group (above); the index universe is limited to emissions for which a tradeable instrument exists. It is further filtered for liquidity, price discovery and rebalanced periodically as the investible market evolves. These indices should be physically replicable by holding the underlying basket and by following the prescribed rebalances as they occur.

-

Specialist Indices and Analytics. Indices and measures which fall outside the groupings above fall into this category. These include for example: dispersion measures for the Real Carbon Price Indices, measures to rank price and scope of emissions globally, different weighting schemes, index subsets covering other forms of emission (for example farming or aviation) and pollutants (such as methane or nitrous oxide).

The Real Carbon Price Indices have been developed by a collaborative research group. This is an ongoing project so the development of new indices and measures, interpretation and discussion is ongoing.

A technical document outlining the indices and methodologies and other supporting material will be released soon.

Please contact us at team@realcarbonindex.org or subscribe for updates and a copy of our latest dataset.